Schedule III cannabis rescheduling is reshaping how the cannabis industry approaches research, formulation, and compliance. For the first time in decades, federal policy is signaling a meaningful shift in how cannabis is classified, researched, and commercialized.

Most of the conversation has centered on cannabinoids, taxation, and banking reform. But nearly all of it misses a quieter, more structural shift happening behind the scenes.

As cannabis moves toward a more regulated, research-driven future, terpenes stand to benefit not because they are new or controversialv but because they sit at the intersection of flavor science, consistency, and regulatory clarity. At the same time, terpenes are non-intoxicating, yet they play a defining role in product experience and consumer trust.

Importantly, Schedule III does not legalize cannabis or eliminate regulatory complexity. What it does do is raise the bar for documentation, reproducibility, and input quality. In that environment, ingredients that introduce ambiguity become liabilities, while transparent, well-characterized terpene inputs gain importance.

Against that backdrop, this article breaks down what Schedule III cannabis rescheduling actually changes, why it accelerates legitimate R&D, and how terpenes emerge as a low-risk innovation layer in a more regulated cannabis market.

To explore how reform directly intersects with formulation science, compliance, and product strategy, this guide connects back to our broader analysis of cannabis rescheduling and live terpenes and what it means for the next phase of the industry. Let’s dive right in.

What Schedule III Actually Changes (and What It Doesn’t)

Schedule III cannabis rescheduling introduces clarity around research and medical legitimacy, but it does not simplify the entire regulatory landscape. A big reason readability suffers in cannabis policy content is because everything gets lumped together. Cannabinoids, terpenes, medical use, reform, legality. All treated as one blob. Schedule III is not that simple, and product teams need clarity, not noise.

Let’s break this down cleanly.

What Schedule III Actually Changes

- Federal recognition of medical use Cannabis is no longer treated as having “no accepted medical use.” This unlocks legitimate research pathways, institutional involvement, and broader scientific credibility.

- Easier research and development Universities, labs, and private research partners face fewer barriers when working with cannabis-related compounds, particularly cannabinoids.

- Tax implications for operators Policymakers expect Section 280E restrictions to ease, improving cash flow and allowing brands to reinvest in formulation, QA, and product development.

- Higher federal oversight expectations With legitimacy comes scrutiny. Documentation, testing, and consistency move from “nice to have” to mandatory.

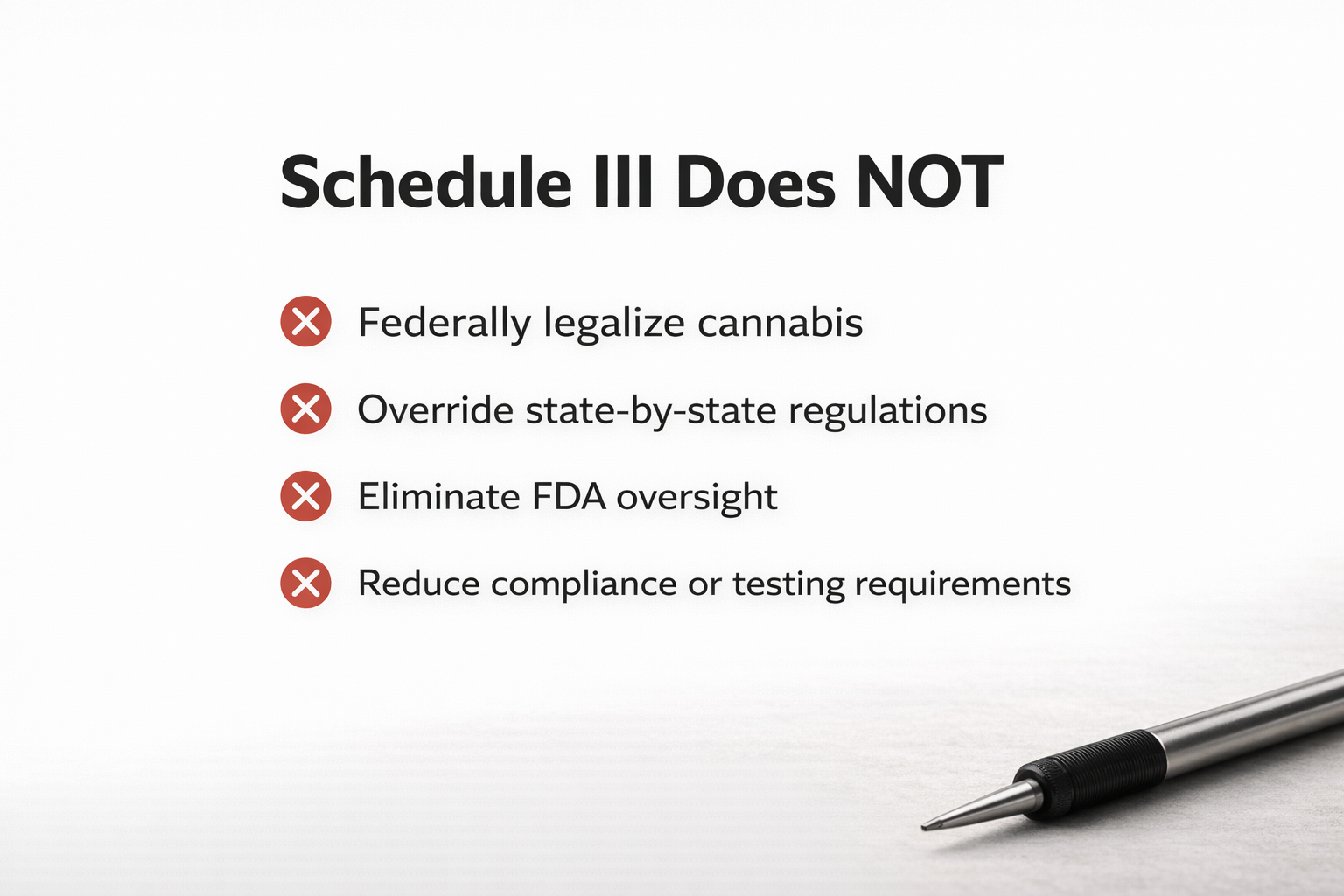

What Schedule III Does Not Change

- It does not federally legalize cannabis: Rescheduling changes how cannabis is classified, not its legal status. Cannabis remains federally controlled, and Schedule III does not grant nationwide legality for adult-use or commercial sales.

- It does not override state-by-state regulations: State programs still govern licensing, manufacturing, distribution, and retail. Operators must continue to comply with local laws, testing rules, and enforcement frameworks regardless of federal classification.

- It does not eliminate FDA involvement: In fact, federal recognition increases the likelihood of FDA oversight around safety, manufacturing standards, and product claims, especially for ingestible and inhalable products.

- It does not reduce compliance requirements: Rescheduling raises expectations rather than lowering them. Regulators and auditors now prioritize documentation, testing, and process control as cannabis moves closer to pharmaceutical-style scrutiny.

In short: Schedule III opens doors, but it also tightens expectations.

Cannabinoids vs Terpenes: A Critical Distinction

In practice, Schedule III cannabis rescheduling affects cannabinoids and terpenes very differently from a regulatory and formulation standpoint. Where most conversations fall apart is failing to separate intoxicating compounds from non-intoxicating ones. That distinction is central to how reform plays out at the formulation level.

| Category | Cannabinoids | Terpenes |

|---|---|---|

| Psychoactivity | Yes (varies by compound) | No |

| Scheduled substance | Yes (plant-derived cannabinoids) | No |

| Dosage scrutiny | High | Low |

| Medical claims risk | High | Minimal |

| Regulatory ambiguity | Significant | Relatively clear |

This is why terpenes sit in a fundamentally safer lane post-rescheduling. They are aromatic and functional, not intoxicating. They shape flavor and experience without triggering the same regulatory tripwires.

Why This Matters for Product Teams

- As cannabinoid claims face tighter controls, brands need alternative ways to differentiate

- Regulators focus scrutiny where risk is highest, which means intoxicants first

- Non-intoxicating inputs with clear documentation become more attractive

Terpenes are not a loophole. They are a legitimate ingredient category that benefits from clarity while everything else becomes more tightly regulated.

The Catch: Not All Terpenes Are Equal

Schedule III does not give cover to sloppy sourcing or mystery blends. As standards rise across the industry, regulators and partners will evaluate terpene inputs like real formulation ingredients.

- Batch-to-batch consistency matters

- Traceability matters

- Testing transparency matters

Cannabis-derived live terpenes align naturally with this direction. They reflect authentic plant chemistry, are non-intoxicating, and can be documented, tested, and reproduced at scale. In a more regulated future, that combination becomes an advantage.

Understanding what Schedule III changes, and what it leaves untouched, helps teams avoid costly assumptions. Terpenes emerge stronger not because rules disappear, but because clarity increases.

Why Rescheduling Accelerates Legitimate R&D

Schedule III cannabis rescheduling does more than shift policy language. It changes who can participate in cannabis research, how products are developed, and what success looks like for formulation teams. The biggest impact is not speed to market. It’s quality of thinking.

As cannabis moves into a more legitimate federal category, R&D stops being a fringe activity and starts behaving like real product science.

Capital Enters the Room (and Changes the Questions)

Institutional capital behaves very differently from early-stage cannabis money. It is slower, stricter, and far less forgiving.

- Institutional investors demand reproducibility, not hype

- Research partnerships prioritize publishable data, not anecdotes

- Risk tolerance drops sharply for undocumented inputs

Schedule III makes it easier for:

- Universities to collaborate with private operators

- Contract research organizations to participate

- Large consumer brands to explore cannabis-adjacent products

When this class of capital enters the ecosystem, formulation decisions are no longer made purely by trend cycles. They are made by evidence, documentation, and long-term viability.

From Novelty SKUs to Repeatable Formulations

Pre-reform cannabis rewarded novelty. Limited drops. Loud strain names. Fast rotations. That model breaks down under scrutiny.

Post-rescheduling, R&D shifts toward:

- Products that can be manufactured the same way every time

- Formulations that survive audits and scale-ups

- Inputs that behave predictably across batches

This is where terpenes quietly move from “finishing touch” to “core ingredient.” Flavor and aroma are no longer marketing layers added at the end. They become part of the formulation logic from day one.

Increased Scrutiny on Inputs and Consistency

As research expands, so does scrutiny. Especially around ingredients that were previously taken for granted.

| R&D Focus Area | Pre-Rescheduling | Post-Rescheduling |

|---|---|---|

| Ingredient sourcing | Often opaque | Expected to be documented |

| Batch consistency | Nice-to-have | Non-negotiable |

| Testing depth | Basic COAs | Expanded analytical profiles |

| Supplier accountability | Minimal | Critical |

Terpenes sit directly in the crosshairs of this shift. Not because they are risky, but because they influence flavor consistency, perceived effects, and consumer trust.

Why Terpenes Benefit from Real R&D Culture

When R&D becomes more disciplined, inputs that can be studied, repeated, and validated gain value.

- Terpenes are chemically defined and measurable

- They can be standardized without psychoactive risk

- They translate across product formats: vapes, edibles, pre-rolls

Cannabis-derived live terpenes, in particular, fit neatly into institutional R&D workflows. They reflect real plant chemistry, respond predictably in formulations, and can be documented in a way that synthetic blends often cannot.

Rescheduling doesn’t just make more research possible. It raises the bar for what counts as real research. In that environment, disciplined terpene formulation stops being optional and starts becoming a competitive edge.

Terpenes as a Low-Risk Innovation Layer

Under Schedule III cannabis rescheduling, terpenes emerge as one of the safest areas for product innovation. As cannabis moves into a more regulated and research-driven phase, product innovation starts to change shape. Risk-heavy experimentation around cannabinoids slows down. Claims become tighter. Oversight increases. In that environment, brands still need ways to differentiate without inviting regulatory exposure.

Innovation Without Intoxicant Risk

Most product risk in cannabis is tied to intoxication. Dosage, impairment, medical claims, and consumer safety all concentrate around cannabinoids. Terpenes sit outside that pressure zone.

- Terpenes are non-intoxicating

- They do not require dosage limits tied to impairment

- They do not trigger medical or therapeutic claims

That makes them uniquely suited for innovation in a post-rescheduling market. Brands can experiment with flavor, aroma, and experience without escalating regulatory complexity.

Flavor, Effects, and Differentiation Still Matter

Even as oversight increases, consumer expectations do not go away. If anything, they sharpen.

- Consumers expect consistent flavor across batches

- They notice when strain profiles feel inaccurate

- They associate flavor with perceived effects and quality

Terpenes are the primary driver of these experiences. While cannabinoids define potency, terpenes define character. In a market where cannabinoid innovation slows, terpene-driven differentiation becomes more valuable.

Why Cannabis-Derived Terpenes Win Post-Reform

As scrutiny increases, the source of terpenes matters more than ever. Not all terpene inputs perform the same under regulation.

| Terpene Type | Strengths | Limitations in a Regulated Market |

|---|---|---|

| Botanical blends | Low cost, easy sourcing | Inconsistent profiles, weaker strain accuracy |

| Synthetic aromatics | Highly repeatable | Flavor feels artificial, growing consumer skepticism |

| Cannabis-derived live terpenes | Authentic plant profiles, strain fidelity | Requires disciplined extraction and QA |

Post-rescheduling, the trade-offs become clearer. Brands optimizing for long-term trust, not short-term margins, gravitate toward inputs that reflect the real plant and hold up under scrutiny.

Why Live Terpenes Are Especially Attractive

- Extracted from fresh cannabis to preserve volatile compounds

- Closer alignment with natural strain chemistry

- Non-intoxicating, yet deeply influential on experience

Live terpenes offer a rare combination: regulatory safety, sensory impact, and scientific legitimacy. They allow product teams to innovate where it’s safest to do so, without sacrificing authenticity.

Regulation Pushes Brands Toward Transparency

As regulators and partners ask harder questions, brands need ingredients they can confidently explain.

This is where many legacy terpene solutions start to fail. Mystery blends and vague sourcing create friction. In contrast, transparent, cannabis-derived terpene profiles fit naturally into a compliance-first mindset.

In a post-reform market, innovation doesn’t disappear. It shifts. Terpenes become the safest place to push boundaries, build differentiation, and future-proof product lines without adding regulatory risk.

What Product Teams Need to Prepare for Now

Schedule III may still be working its way through timelines and agencies, but the operational shift has already started. Product teams that wait for “final clarity” will be reacting instead of leading. The smart move is to prepare for higher standards now, especially around inputs that touch flavor, consistency, and consumer trust.

This is less about panic and more about tightening fundamentals.

1. Documentation Becomes Non-Negotiable

In a more regulated environment, undocumented inputs are a liability. Product teams should assume that every ingredient may need to be explained, justified, and traced.

- Clear COAs for every batch

- Defined chemical profiles, not vague flavor descriptions

- Repeatable specs that survive audits and reformulation

For terpenes, this means moving away from generic “strain-style” blends and toward inputs that are chemically characterized and consistently reproduced.

2. Supplier Traceability Matters More Than Price

As scrutiny increases, who you source from matters as much as what you source.

- Can your supplier explain how the terpenes are extracted?

- Can they document origin, process, and batch variation?

- Can they scale without profile drift?

Inconsistent suppliers create downstream risk. Reform favors partners who treat terpenes like real formulation inputs, not flavor additives.

3. Stability and Reproducibility Become Core KPIs

Rescheduling accelerates the shift from experimental SKUs to durable products. That puts pressure on terpene stability across formats.

| Product Format | Key Terpene Requirement |

|---|---|

| Vapes | Thermal stability and clean volatilization |

| Edibles | Flavor retention through heat and processing |

| Pre-rolls | Aroma consistency and shelf stability |

If terpene performance changes batch to batch, the product does too. In a post-reform market, that variability becomes unacceptable.

4. Consumer Trust Is Built on Accuracy

As marketing claims tighten, consumers rely more on sensory cues to judge quality. Flavor accuracy becomes a proxy for credibility.

- Inaccurate strain profiles erode trust

- Artificial flavor notes stand out more over time

- Consistency signals professionalism

This is where cannabis-derived live terpenes create leverage. They align more closely with the plant’s natural chemistry, making it easier to deliver repeatable, believable experiences.

5. Prepare for the Long Game

Schedule III is not a finish line. It’s the start of a more disciplined era.

Product teams that invest now in documentation, traceability, and terpene quality will be better positioned as standards continue to rise. Those relying on shortcuts will spend the next few years retrofitting processes under pressure.

Terpenes are no longer a finishing touch. In a post-rescheduling landscape, they are part of the foundation.

For a broader view on how reform reshapes formulation strategy, sourcing, and long-term product planning, revisit our pillar on cannabis rescheduling and live terpenes and how forward-looking brands are preparing now.